Bidding Your Business Insurance Is A Bad Idea

So it's time to shop or review your business and commercial insurance program. Maybe you're coming up for renewal, maybe you're launching a new venture. If you do what most people do, you're going to go out to market, you're going to talk to three, four or five different agents and offices, you're going to solicit a bunch of quotes and you're going to sit back and look at everything and try to figure out the best way to proceed with the options in front of you. What if the conventional wisdom isn't actually the best way? What if doing it the same old, same old way is actually detrimental and potentially dangerous for your business? In this video, we're going to talk about the broker selection model and why bidding for your business insurance may actually be a terrible idea.

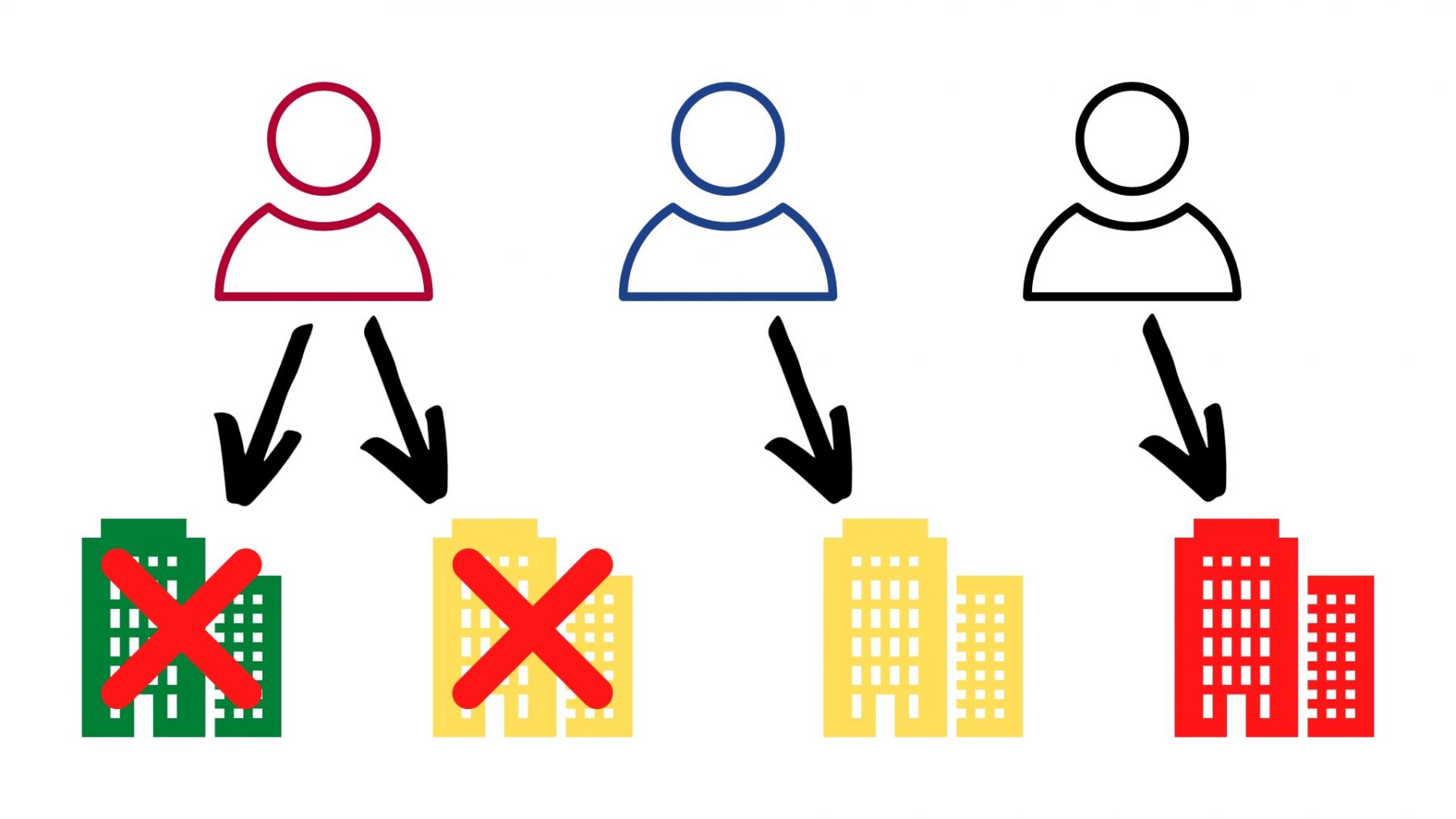

So to illustrate this point, we're going to tell a little story. We're going to take you through a little bit of a journey. So here in our story, we have three insurance agents in the marketplace, and we have a total of four companies. If you're going to go out and shop like most people, this is a good estimation of what you'll find in the marketplace. And in those four companies, we know that not all companies are created equal, right? There's some great, there's some really bad and there's a bunch that are just in the middle. So in these four companies, we have the best company and then we have two that are good, but not great. They're not amazing, but they're also not terrible. They could be a good option for you to consider. And finally, we have a bad company. This one is going to give you a great price and a terrible everything else. This company should be avoided at all costs because you will be brought in, you'll be lured by the low premium cost and you'll be less likely to pay full attention.

So, let's tell a quick story about these three agents here at the top. Agent 1, there on the left, is the first agent that you spoke to and you are okay with letting them go to market. But this agent is not the best in our story for a variety of reasons. Maybe it's staffing at their office, maybe they don't have the expertise, maybe they've only been in business for a year or two. Maybe they don't have exactly the right market for every situation, maybe they don't have the right technology in their office, who knows? We're not going to dig into exactly why Agent 1 is not the best choice, we'll simply say that Agent 2 here in the example is the best choice.

The best overall value, highly experienced, great resources, their staff is well trained, they're very prompt in communication. They give you an excellent client experience. Agent 3 here at the top is a supporting cast in our story. They are not really in the running. Maybe you're including that third agent for due diligence or someone on social media's suggested that they got them a good price. The problem here is Agent 3 is just in it for themselves as we'll see here in a second. So what happens in the traditional bidding process? You go to Agent 1 first. So, Agent 1 has open access to the market. They represent the best company and they represent a good one here. They don't represent company three for whatever reason. But in our example, they are going to these two companies and they're soliciting bids to go and put something in front of you to try to win your business.

So Agent 2 then gets started after Agent 1 has started and they are going to market and they are trying to do the very best that they can. They would like to have you for a client. You had a great first meeting, a great discovery call and they like you and you like them. So what's wrong here? Can they go to company one and company two? Not so fast, my friend. When they go to the market, company one and company two are not available to them because Agent 1 got there first. And that means that they're not able to deliver those recommendations to you, so they go out to market and are stuck finding the very best option that's available to them. They go to company three here. Now, let me explain exactly what's happening here because if you've never dug into the details of how it works in the business and commercial insurance world, you may not understand what's happening here and why it's so critically important to do the broker selection model instead of traditionally bidding for your insurance.

Because in the commercial insurance world, every company out there will only work with a single retail agent at a time. So when the company delivers a quote to an agent, they won't work with any other agent, only one at a time. It's not like in personal lines where you can go out and let's say you wanted to get a homeowners an auto quote for your personal insurance. You can get 5, 10, 20, who cares? Many different quotes from the same carrier, different agents can access the same carrier and put different quotes in front of you. That's a confusing story for a different day. But for the purposes of our conversation here in the commercial and business insurance world, just know that once a retail agent has contacted a company, they are what's called blocked for all other agents. So even if the best agent is Agent 2 here, they can't access the best company because of the way that the bidding was done here in this process. So let's go ahead and jump back into our screen.

So what about Agent 3? Agent 3 here is wanting to play ball. They want to win your business, you would be a big client for them. So what are they going to do? They're going to go to whatever company they can find. They're going to get the lowest price because they know that most people are likely to buy based on price first and to give full consideration to the lowest cost option regardless of what the other factors might be. Now, why didn't Agent 2 go to the bad company? Well because Agent 2 has standards. Agent 2 doesn't want to put a bad program with a good price in front of a prospective client because Agent 2 is a legitimate professional. Agent 3 is just a salesperson. They are someone hawking a product. Agent 3 does not deserve your business. So what happens in this process? What is the problem here? The typical way of shopping for insurance really overly samples makes two important upfront cost and it commoditizes what should be a professional relationship.

So the worst case scenario here, the worst thing that could possibly happen is the best agent can't access the best solution and you end up guaranteeing yourself an inferior client experience. You get stuck with something that is less than the best. We definitely don't want that to be happening. So what is the better way? It's called the broker selection model and it definitely is the better way. You're already familiar with this selection process because it is the standard in every other white collar professional relationship, whether we're talking about your attorney, your CPA, banker, a financial advisor, every other white collar professional relationship that you have works on this way. If you think about it, you're not going to out and ask three different attorneys to draft contracts for you and decide which contract you like the best. It simply doesn't work that way. It shouldn't work that way when we're talking about your commercial insurance, your risk manager relationship.

So the way that the broker selection model works very simply is we are pushing and saying that it is best to make a decision based on critical factors that are not product or price-based, but instead focused on the expertise, the knowledge, the experience, the advice that you're going to get from your professional, the resources that they can provide. Yes, of course market access is very important, but there's lots of other things that come into play, like the use of innovative technology of good communication platforms that enable you to get what you need faster and easier from your insurance program. The total value of the relationship, what are you getting other than the purchase of an insurance product? Are there any value added services? Are there any resources and documents and useful white papers or other things that they put in front of you? Maybe it is a safety evaluation. Maybe it's some learning management center or assistance with making sure that you're ready from a regulatory or a contractual setting. There's so many different ways that a good commercial insurance agent and risk manager can add value to the relationship. And lastly, just the overall look and feel. How do they make you feel as a client? Because what we're really trying to make happen here is the best outcome, and that is for the best agent to be able to have open access to the marketplace so you can make sure that the best agent is able to deliver the best solution for your needs.

Now obviously, you may be thinking, "Now, wait a second, James, what if I've already talked to multiple agents? What if I've already gone through the process and complicated everything?" Well that's fine. We can easily correct that. And it's through a simple process called the Broker of Record letter. And the beauty of it is you as the client have total control of the marketplace. You get to dictate to agents and companies who your representative is.

So if you've already talked to two, three, four, or five agents, that's okay. You can still designate your chosen representative by simply signing a broker of record letter, which means that the agent that you feel most comfortable in working with, the one that you know, like and trust more than their peers, the competition who are trying to win your business, that is the way that you designate and fix the whole thing. So you can make sure that whoever ends up with market access is the right fit for you.

Now obviously, there is a process to this and the discovery process really is what we're talking about because here at RiskWell, we engage in a very intentional thoughtful discovery process with every prospective client that we work with. That is how we determine if it's a good mutual fit, if we are a good fit for you, if you are a good would fit for us, because unlike most of our peers out there in the marketplace, we absolutely have standards. And we are not interested in working with everyone who comes and says, "Hey, can I get a quote?"

Well you can't get a quote because we don't do quotes, we engage with clients and figure out the best way to move forward. So obviously, we're not saying upfront, "Hey, if you want to get a quote, you have to promise to do business with us." Of course that would be ridiculous. That's not what I'm saying at all. What I am saying is this is a better way to do business. It guarantees the highest likelihood that the right agent is going to have access to the right solution for you so you end up having the best overall client experience. So if that sounds like a refreshing and effective way to do business, then great, you're talking to the right office. If you're watching this video, it's because I sent it to you or a member of my team did and said, "Hey, this is how we do business." Maybe you're watching this video because you've already filled out a quote request form on our website and you were dropped on the landing page where this video exists. It's on YouTube and on our website, I'm not sure where you're watching it right now.

So moving forward is the discovery process. If you like what you hear, if we like what we hear, then we go ahead and do the engagement process and then we go to market on your behalf and do what we do. That's it for this video, boys and girls, please make it a great day. And remember, life is risky. RiskWell.

Let's Have A Conversation

Schedule your Discovery Call below. We'll get acquainted and work to understand your needs and preferences. Then, we'll build a custom program that protects you, your business, your family, and your livelihood.